Amkor’s Prasad Dhond Discusses the Automotive Market in an Interview with AnySilicon

Tell Us a Bit About Yourself and Your Background

I have worked in the semiconductor industry for 20+ years. I started at Texas Instruments where I held roles in engineering and marketing analog Integrated Circuits. After 12 years at Texas Instruments, I joined Amkor Technology where I currently hold P&L responsibility in the Wirebond Business Unit. I led Amkor’s automotive strategy from 2017-2020, which sparked my interest in the automotive semiconductor market which I follow very closely.

The Automotive Market Has Been Growing in Recent Years, Which Segment(s) Do You Think Will Grow Most in the Near Future?

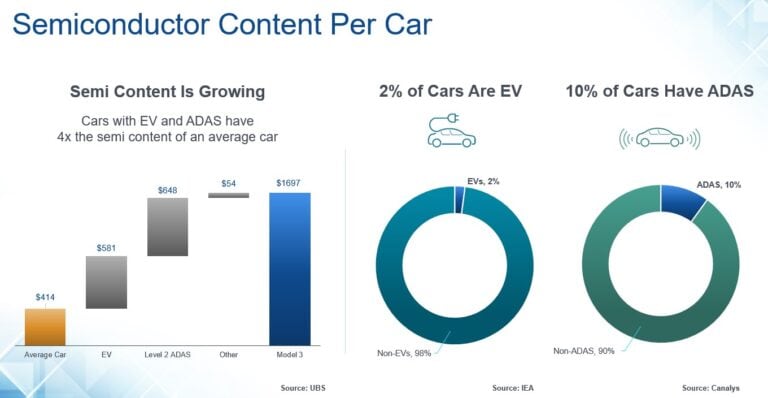

The total number of vehicles sold each year is flat, but the electronics content per vehicle is growing significantly driven by Electric Vehicles and Advanced Driver Assist Systems (ADAS). In the past 20 years, the semiconductor market has doubled two times. In the 2000s, semiconductor content growth in cars was driven by safety mandates such as electronic stability control (ESC), Tire Pressure Monitoring System (TPMS) and brake assist. In the 2010s, with the proliferation of the smartphone, also came a rise in screens in cars with infotainment systems and ADAS Level 1 (L1) and Level 2 (L2) features. We also saw the rise of powertrain electrification with hybrids. The next phase of growth will be driven by ADAS L2+ moving towards autonomous vehicles and the move towards fully electric vehicles. While the past 2 market size doublings took around 10 years each, the next doubling is likely to be faster due to the growing semiconductor content.

The chart above is a great representation of the semiconductor content story. It compares the semiconductor content of an average car running on gas vs. a Tesla Model 3 which is an EV and has ADAS L2+. The average car running on gas has ~$400 of semiconductor content. The electric powertrain adds $600 and the ADAS L2+ adds another $600 to the car. So, a car with an electric powertrain and ADAS L2+ has >4x the semiconductor content of a regular ICE. What’s interesting is that only 2% of the 1B cars on the road are electric. And only 10% of the 1B cars on the road have ADAS. So a huge growth opportunity lies ahead as the current stock of cars on the road is eventually replaced by EVs with ADAS.

Perhaps You Can Tell Us About the Main Differences Between an Automotive Package Requirements and an Industrial/Consumer Package?

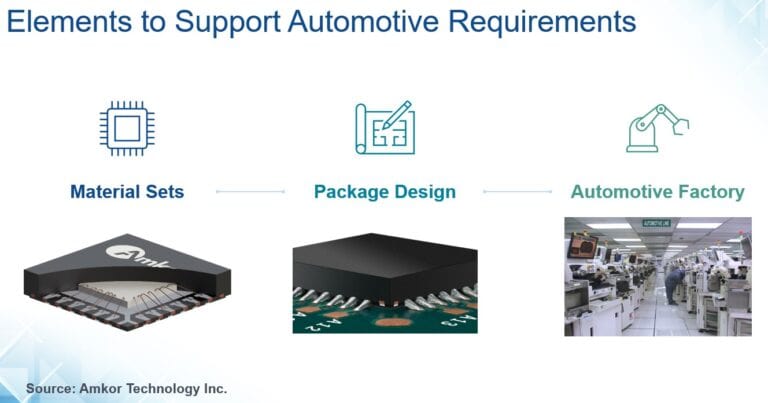

To address reliability challenges, automotive ICs are packaged somewhat differently:

- Automotive ICs use enhanced material sets to achieve better reliability performance. For a QFN package, this would mean using the latest variations of copper bond wires, Epoxy Mold Compounds with optimized levels of Sulphur, and leadframes that use the right finish and surface treatments such as roughening.

- Automotive Packages have special design features for better system-level reliability. QFN is a leadless package that is popular in automotive applications. However, when soldered onto a board, it is difficult to visually inspect its solder joints. So for automotive applications, QFNs use special leads (called Plated End Leads) that allow the formation of inspectable solder fillets as shown in this picture. These solder fillets can be inspected by an Automated Visual Inspection machine for greater assurance of the integrity of the solder joint.

- A factory assembling automotive ICs must have necessary automotive certifications such as IATF16949, but these are table stakes to be an automotive supplier. They also need to have tighter controls such as designated automotive equipment, designated automotive operators, special process flows that include more inspections along the way.

Do You See Any of the Quality Requirements Changing in the Next Few Years?

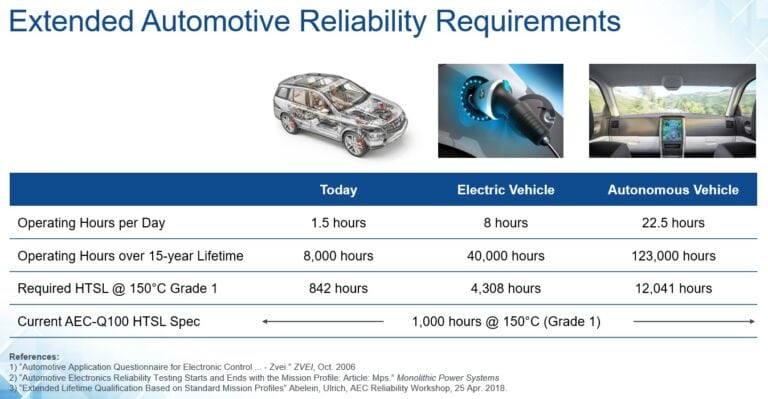

Automotive end users often demand 2x or higher reliability levels compared to what is specified in existing automotive (AEC) standards such as AEC-Q100. This is because reliability requirements are driven by operating profiles and operating profiles of automotive components are changing.

We have a lot more “always on” automotive applications today. In the past, when we turned the car off, everything turned off. However, today even after the car is turned off, many applications are still running – the infotainment system, the window and door controls, etc. Some EVs have cameras and fans that are in use for safety and monitoring.

The average vehicle operates for 1.5 hours every day, translating to 8000 operating hours over a 15-year lifetime. In this case, 1000 hours of reliability testing (High Temp Storage Life @150 C specified by AEC-Q100 Grade 1) is sufficient.

However, say you have ICs in an electric vehicle that interface with the charging/battery circuits. The operating hours for these ICs are now 8 hours per day: 1-2 hours of driving, and 6-7 hours of charging. This translates to 40,000 hours over a lifetime and >4000 hours of HTSL reliability test.

Moreover, if autonomous vehicles become a reality, many more ICs will be running even longer hours and the reliability requirements will stretch out even further.

What Are the 3 Top Automotive Challenges That You See in the Semiconductor Industry Today?

There used to be a lag of ~8-10 years for automotive adoption of major process nodes. Today the lag has reduced significantly with processors using 7nm and 5nm in automotive already. Similarly, the packaging used for these processors has evolved. From using wirebonded packages for the early processors to Flip Chip packaging used today, we see further evolution towards Multi-Chip Modules where a processor, memory, PMIC, etc are all housed on a single substrate. With more advanced nodes 2.5D packages are on the automotive roadmap in the not-too-distant future. So the time to maturity of automotive semiconductor technologies has reduced significantly.

Other challenges are supply-chain-related. One of the reasons for the big boost in automotive semiconductor revenues in 2022 has been that auto suppliers have shifted inventory strategies from “Just In Time” to “Just In Case”. They are taking a hard look at the supply chain and geographical location of those suppliers. There is a lot more effort in business continuity planning. There is a preference for more localized supply chains with many of the large OEMs and this gives an advantage to geographically diversified suppliers.

Lastly, the auto semi landscape is evolving rapidly and semiconductor suppliers have to adapt to this shifting landscape:

- Car OEMs are developing their own chips as seen with Tesla’s Full Self Drive processor

- Many Tier-1s already make their own ICs and others are starting to

- Fabless semis like NVIDIA and Qualcomm have become automotive players with ADAS and Infotainment on the rise

- Top players have cemented their positions by merging with other automotive suppliers (Infineon Technologies-Cypress, NXP Semiconductors-Freescale, on semi-Aptina, Analog Devices-Maxim)

Which Type of Packages Would You Suggest for Small Mixed Signal Chips (below 100 pins)? and for a Higher Pin Count?

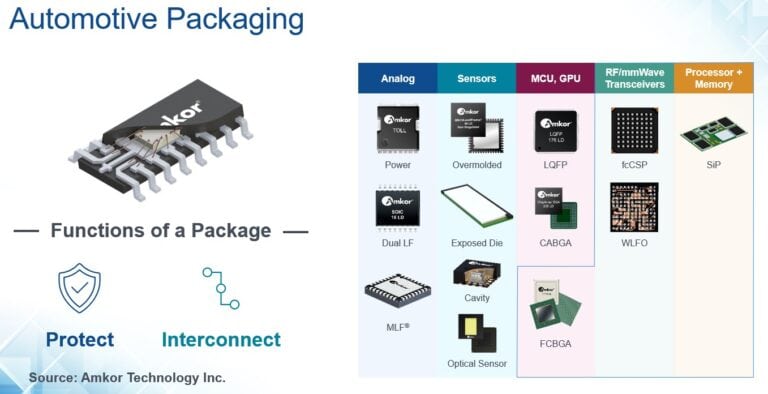

The two key functions of an IC package are to protect the semiconductor chip and provide a reliable interconnect to the outside world. It also serves other functions such as heat dissipation and providing mechanical support. These are the same functions the packages must perform in automotive applications as well but with different challenges.

Depending on the application, here are the IC packages popular in automotive applications:

- Analog ICs (signal chain and power) use leadframe packages such as TO, SOIC, TSSOP and QFN. Power modules are used for EV powertrains

- Sensors could be overmolded for inertial sensors like gyros; exposed die for temperature/humidity sensing; and cavity-type for pressure sensors. Optical sensor packages are used to package CMOS image sensors used in ADAS cameras

- MCUs are primarily packaged in LQFP and CABGA (wirebond), whereas GPUs/SOCs are in FCBGA

- 77GHz radar transceivers use WLFO and fcCSP

- SiPs are used in some cases to package the processor, memory and other components onto a single substrate

- Although wirebond packages are dominant in automotive, there’s a trend towards increased use of advanced packages as ADAS processors and radar ICs proliferate

How Are You Different from Other Assembly Vendors (OSATs) in the Automotive Market?

Amkor is the largest OSAT for the Automotive Market. We offer an extensive portfolio of automotive-ready packages and test services for the entire spectrum from mature wirebond to advanced packaging. We have more than 45 years of experience providing packaging and test solutions for automotive semiconductors and have manufacturing locations throughout Asia, and also additional locations close to automotive OEMs in Japan and Europe. Our experience includes decades of working with not only top automotive semiconductor suppliers but also Tier-1 suppliers as well as OEMs through various developments, audits and problem-solving. This rich experience along with scale and geographic diversity (for manufacturing locations) gives us an edge in the automotive OSAT market.

Learn more about AnySilicon, visit https://anysilicon.com/